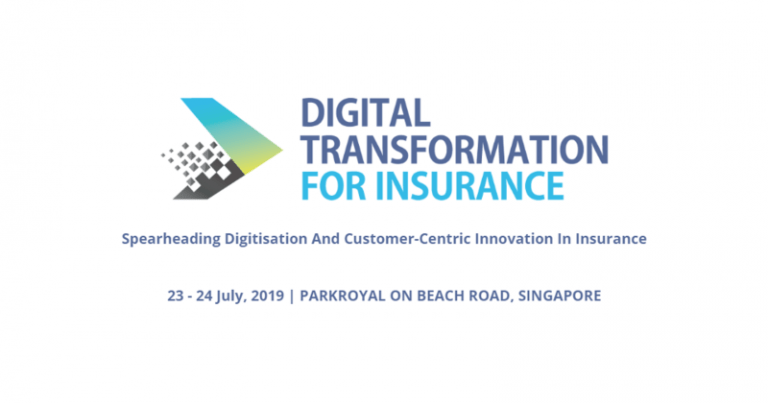

The insurance industry is now on the verge of a paradigm shift as the evolving customer preferences has prompted the need for digital transformation. In response to tech-savvy and modern day consumers, insurance companies are looking for new ways to increase efficiency, achieving operational excellence, and enhance end-to-end customer experiences. But they are also presented new challenges and investment requirements.

Joining the Annual Digital Transformation conference (23-24 July), FPT will be introducing the latest digital innovations and cutting-edge technology that is shaping the future of insurance. From underwriting traceability, call center abnormally detection to insurance telematics, we will be demonstrating hands-on demos that could help insurance companies, banks, as well as other financial service providers navigate their digital transformation journey.

Now on its third year, the Annual Digital Transformation conference gathers thought leaders and practitioners from the world leading insurance companies including Allianz, Manulife, Generali, and QBE Insurance. Summit themes include:

- Accelerating business digitalisation for agile operations and customer excellence

- Implementing a digitally-empowered and seamless omni-channel customer experience

- Growing new market segments through insight-driven product innovation and strategic partnerships

- Developing a winning multi-channel distribution model, including direct digital, agent empowerment and more

- Embracing digitisation and automation to transform onboarding, underwriting, payments and claims processing

- Harnessing artificial intelligence to drive customer value and business growth

FPT booth will be at Stand 2, Grand Ballroom 3, Level 1, Parkroyal on Beach Road, Singapore. Meet us to explore how you can strengthen your enterprise capabilities across operations, marketing, distribution and products for enhanced customer engagement and experience.

For more information about the event, click here.